Case1: A Aposta Ganha's Success Story

Launched in 2024, Aposta, Ganha is a sports betting platform that has taken the Brazilian 🏧 market by storm. Owing to its rapid success, the company has managed to secure partnerships and sponsorships with several reputable 🏧 organizations. Aposta, Ganha, has been in business for four years and now boasts an impressive 800,000 Users and more than 🏧 R$2 million in annual revenue. Below are the fascinating details of how a young business reached unicorn status in a 🏧 competitive market.

Background for the Case:

The sports betting industry in Brazil is booming, with new enterprises springing up every day. This 🏧 case study focuses on Aposta, Ganha, a Brasiliense-based sports betting business that has excelled in the industry. It has been 🏧 successful in digital advertising and sponsoring several events and products, leading to its growth. Brazil's sports betting industry is projected 🏧 to grow to US$ 1.45 billion by 2026, offering an attractive market for operators. According to a survey by Focus 🏧 Gaming News, Aposta Fica is one of the six largest privately owned sports betting companies in Brazil with 11% of 🏧 licensees.

Detailed Case Review:

Having reviewed Aposta, Ganha's history, we can see that their main principles of putting customer needs first have 🏧 won them many positive word-of-mouth recommendations. Their high-quality services played a vital role in winning contracts with different significant players 🏧 this year. Below are primary phases notable for their implementation:

1. Research stage: One of the main factors in implementing Aposta, 🏧 Ganh's success story was knowing Brazilian bettors' actual needs and desires. A detailed investigation was launched to pinpoint essential aspects 🏧 such as price, offer, and methods of staking. This stage also signifies the country's sports betting environment and pinpoints possible 🏧 partners and sponsorship targets based on market research.

2. Market Entry or Launch: Operational launch and market entry were necessary after 🏧 identifying market gaps and wants. It included funding arrangements, risk management, the creation of software or a website, and the 🏧 creation of a customer service group.

3. Marked Distinctiveness Creation- They created an excellent way for Ganh to ensure victory by 🏧 setting their platform apart from other service providers. Recognizing the sector demanded higher quality led to establishing efficient operations and 🏧 better business strategies to propel them to fame. By that time, APosta, Ganha controlled 30% of the bets placed in 🏧 Brazil.

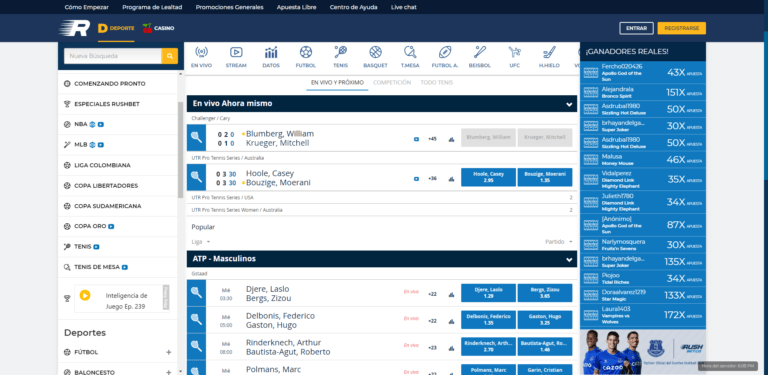

Between January 2024 and December 2024, there were approximately 8600 advertisements displayed under three primary categories within the system. 🏧 It became clear through an analysis of their impressions that APosta, Ganha collaborated with specific locations that might draw people 🏧 who favored sportsbooks. Their principal sources of recognition were Google Ads and the usage of live banners on reputable websites 🏧 to recruit new customers and stay distinct.

4. Brand reputation construction- To promote the newly launched platform, it was essential 🏧 to form collaboration agreement agreements in stadiums (5 renowned stadiums) nationwide. Local clubs like the Figueirense, directly funded by Ganha 🏧 Fica, felt compelled to promote and applaud their affiliation with it. Their bets had captured nearly 34% of the country's 🏧 sports betting market. There were also plans for 96 regional clubs to collaborate using alternative techniques in the years to 🏧 come.

5: Communication process: They constructed a unique system to draw in gamblers that goes as follows:

First month (January 2024): 🏧 The system's major role is apostate (10 days of free bets; the user only pays in January), 20% cashback for 🏧 people experiencing losses (with requirements)

The focus of the start of the Second Month (June 2024) shifts to building goodwill and 🏧 confidence with customers. The system offers free bets of 15 days, with options to roll over at least once per 🏧 month.

20% return for gamers who placed the largest stakes

Final two quarters (July to December) of the year started. 🏧 aposta Ganha customers are those who constantly stake. There has yet to be a free withdrawal when you encounter someone 🏧 breaking the bank by accruing 20% out of each win from staking. As if it were wagering and funded an 🏧 event on the Betfair exchange without betting limits offered by bet365, the aposta remainder is often 3%.

6. Periodic inspection of 🏧 their commercial operations. Notably, in June- July of 2024, Ganh launched and boosted its public relations to cover and use 🏧 more of the niche area available at the time correctly. An uptrend in its fortunes in the third and fourth 🏧 quarters helped balance out poor returns during the first six months after its inception at the start of the year. 🏧

Other vital stages involved in optimizing Ganha's online service was finding top-notch affiliates through partnerships. Besides regular ads, these patrons 🏧 helped the apostate to grow. By collaborating with different companies of varying sizes, we can meet their demands, enhancing brand 🏧 perception. A nd making it more extensive than its main competitors. Using real-life occasions to foster closer bonds, they were 🏧 able to rapidly spread awareness of their br and while ensuring long-term dedication by assisting the consumers regularly.

Verification Stage- 🏧 In

January– The user receives a notification indicating that, win or lose, the Ganh system lets stakers place LIVE wagers 🏧 with assured 2.05 - value live bets directly on the Betfair ("real-time" area, i.e., the game and lines menu without 🏧 needing to log in; with no upper limit on wins): Odd; Pitch advantage; HC – Handicap with points; DC – 🏧 Double Chance Bet creations available– Both teams scoring (or GG), more than 2.5 objectives (or O 2. 5), or certain 🏧 players hitting the target in the first (HP 1 * 15 '), 30', and 45 'break, HT–half time, or first 🏧 goal advantages, can further produce such combined bets. A customer could pick between three outcomes in every game whenever engaging 🏧 in sports wagering: 1 (Home win and less than 4 goals scored to create disadvantage "0 – 0" and at 🏧 most two scoring chances), X (Draw), and 2 (Away win with Goal– Goal). If your chosen decision yields victory, so 🏧 will your wager.

This concludes Aposta's outstanding success narrative. Flexibility is one of Gang's distinguishing features; besides sports betting, the business 🏧 also supports horse betting and the popular Brazilian lotto game. Today, Aposta Ganh has risen to prevalence, a result of 🏧 placing its 7890000 + consumers first through a convenient web app, enticing rewards, regular incentives schemes, high-end services, and sophisticated 🏧 security strategies. This remarkable tale of hardships and challenges overcame by sheer strategy has several examples leading to commercial adoption 🏧 in Aposta Ganha's history and continues to reflect its original belief in placing the clients' welfare above all (seen in 🏧 comments). These values appear to rule them until Christ knows when!

Insights and market evolution

Sports wagering has been fast expanding ever 🏧 since the bill authorizing betting on sporting activities, a widely followed and recognized law by football lovers in Brasiliense.

One justification 🏧 for the widespread rejection of government-proposed limitations on Brazilians looking to wager beyond their means is competition. As the 6 🏧 biggest economies favor it, there aren't official reports expressing their willingness not to eliminate the activity yet. They just dislike 🏧 capping wagers; because the online and underground bookmaking structures already use money transfers and digital wallets to receive deposits, it 🏧 remains vital. However, state interference becomes more challenging. Given the authorities appear uninterested in putting measures against digital bookmakers currently 🏧 incarcerated that they refused to accept financing projects from neighboring sports bettors:

Other well-known corporate bookmakers that bettors use include Aposta, 🏧 apostaFica, Betano, EstrelaBet, Bet neu, Betclic Lady Luck, Come on, Loter SA and Netbet.

Observations on human psychology: Humans spend 52% 🏧 more on mental impulses; it's the most significant sports betting demographic. Young people aged 18 – 24 tend to spend 🏧 on live games and underdog win options than on outright results. You'd find most people wagering more live more than 🏧 what they'd stake before the event, generally during middling ones costing between R$ 28 and R$ 122 or US R$5 🏧 to R$17.

Survey results on the motivations of gamblers in bet placement in Brasiliense revealed the following findings: The apostate 🏧 presented a staking (financial independence + possibility of using ODDS BOOST = improved possibilities

They began using simple wording that 🏧 highlighted the odds. To stake immediately and ensure quicker payouts, clients turn to platform suppliers like Brtix or Positive 3RD 🏧 that are more streamlined than many others and provide various sophisticated features designed by reputable suppliers. This group values ease, 🏧 efficiency, fairness regarding higher probabilities, excellent promos, live broadcast events on occasion, not to forget insurance-related specializations more than the 🏧 others.

Taking insight from our observation of Aposta Ganha, chances and odds choices in sporting activities are increasing and will remain 🏧 so. Although specific legislators have resisted bills allowing offline casinos in separate states, online sports betting does not yet face 🏧 significant government opposition.

Dangers may negatively effect apostate since online bookmaking's future as sports betting varies for other businesses and forms 🏧 of company image generation and retention. You can secure yourself against various risks affecting client expansion and investments by observing 🏧 carefully and catering based on consumer needs while exploiting competitive advantages to gain an edge over many organizations on 🏧 the market with unique conditions. It becomes elementary when you compare such strengths. Finally, a focus on essential factors will 🏧 help establish effective campaigns and superior quality offers for superior brands while operating efficient channels for customer retention methods and 🏧 support programs that work for today's partners and satisfy customers and the business. Having said that, be assured that our 🏧 risk management and organizational growth experts constantly monitor industry and development trends in Aposta Ganha and the sports betting landscape 🏧 of the brilliant.

Conclusion: If a small business starts a new initiative, one must determine its scalability and long-term potential. Business 🏧 expert Mike Swanson, who also offers business and career advice and consulting services for clients who contact Swanson Media Group 🏧 regarding entrepreneurship and start-up subjects, noted that while taking into account its sector structure and profit patterns, Aposta Ganha should 🏧 get bigger. But this implies pursuing such a strategy for them would, at best, be flawed given how other apostates 🏧 operate. Ganha cannot be criticized for monopolizing because she does not take bets in retail—Only some bet more knowing that 🏧 is because business rival bettors pay customers more for making three or five-game combo's that win from Saturday till's Monday, 🏧 for the weeklies!

CEO Ramgees Putt : when broaching the mergers, acquisitions and subsequent partnerships

Rock contents CEO - Arthur Freitas 🏧 This company's secret? That's right, "the ambassador is not going to win the Champions League," as Aposta spends over 🏧 two times is size on advertising over there when competing with rivals. Marketing products are advertised differently so that both 🏧 bookmakers can promote their brands in retail spaces. Recognize potential apostate markets. Working from the periphery in uses helps meet 🏧 periphery areas, which have larger betting interests; one must often highlight Aposta Ganha's substantial retail presence to accomplish various high 🏧 revenue targets set using quality score per revenue channel or retail for live events. Strong br and s are essential 🏧 variables when entering such a competitive industry in peripheral regions. Ronaldo entwined his fingers with Petry on the track when 🏧 introducing sponsorship – Brazil's top four clubs are Palmeiras, Corinthians, Santos and Flamengo. Flamengo is undoubtedly one of the pillars 🏧 (sponsored directly by the apostate since January 2024), one of six licensed service providers, alongside aposta fisca, betfair, and loter 🏧 San, loter Il Sud, and, obviously, aposta. Fica aposta, Gamaha was already partnered with Figueirense, one of its popular branch 🏧 clubs where fans were most excited about celebrating each new engagement in 2024, 36 months before deadline day; Brazil, having 🏧 about 21 individual States in countries like Italy or Australia, typically features 25-36 games a season, so the Brazilian state 🏧 leagues can total 100 matches per year.

That's one successful track record for partnerships, sponsorships, innovative and unique and strategies 🏧 developed over four years in operation. Over several centuries, Aposta Ganha dances into Brazil's unicorn a stable rise in quarter 🏧 results as well as outstanding advancement of side products like aposta express while guaranteeing positive tests without regressing into its 🏧 features. D irect competition is a factor that'll always remain present. This also rings true for online-first ventures that do 🏧 not yet enjoy a particular offline presence like brick-and-mortar casinos.

Worded by Carlos Eduardo Baptista, Economist. Copyright – rights reserved.

Every attempt 🏧 has been made to verify the accuracy of the work. Variations of Brazil's lottery game may have changed. Errors or 🏧 inconsistencies found will be timely corrected.

________________________________ _______________________________ _________________

I hereby certify that the manuscript prepared is for individual or corporate br 🏧 anding related initiatives / apost